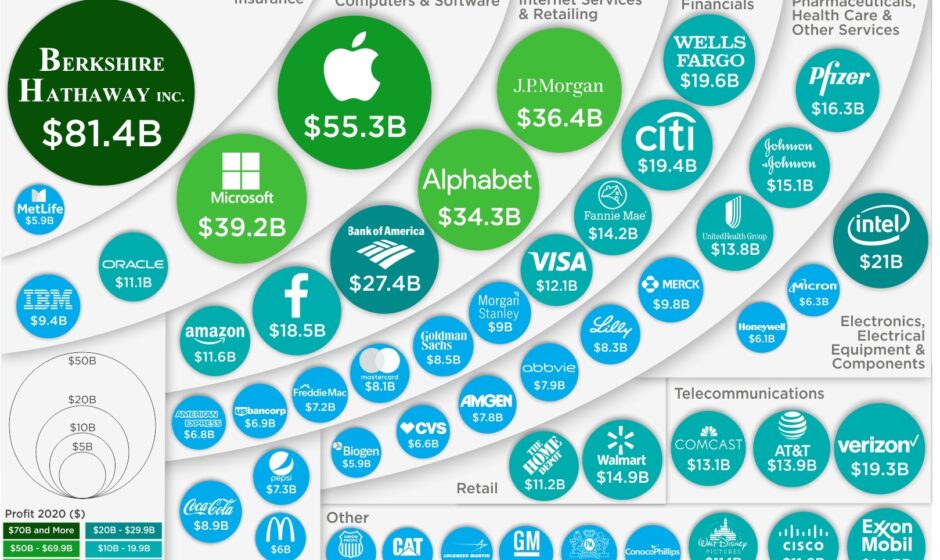

The most profitable businesses in the USA typically revolve around technology, healthcare, and financial services. These sectors consistently show high profit margins and growth potential.

Identifying the most profitable business ventures in the United States is crucial for entrepreneurs aiming to maximize returns. The landscape of American business is diverse, filled with opportunities for those with keen insight. As of my last update, companies in the technology sector, such as those specializing in software, internet services, and electronics, hold the top spots for profitability.

The healthcare industry is not far behind, with pharmaceuticals and medical device companies reaping substantial rewards due to the ever-increasing demand for medical innovation and health services. The financial industry also stands out, with investment firms and banks generating significant profits from their financial products and services. These industries are bolstered by a strong consumer base, advancements in research and development, and a market economy that prizes innovation and efficiency. As an entrepreneur eager to tap into the American market, understanding these key sectors could serve as a gateway to substantial profitability.

Credit: www.fourthmanfilms.com

Introduction To Profitability And Business Landscape In The Usa

The United States of America boasts a dynamic and diverse business environment that presents a myriad of opportunities for entrepreneurs and investors alike. Profitability remains the cornerstone of business success, and in the USA, where the market conditions are as varied as the industries themselves, understanding the landscape is foundational for any profitable endeavor. Entrepreneurs embark on ventures that promise return on investment, and this is shaped by numerous factors, from innovation and strategy to market demand and economic stability.

Understanding The Metrics Of Profitability

Profitability is not a one-dimensional concept. It encompasses a range of financial metrics that business owners utilize to gauge their company’s performance. Key indicators include net profit margin, return on assets (ROA), and return on equity (ROE). These metrics are vital in assessing a company’s ability to convert investments into profits effectively.

Let’s explore these metrics briefly:

- Net Profit Margin – reflects the percentage of revenue that remains after all expenses have been deducted.

- Return on Assets – indicates how efficiently a company uses its assets to generate earnings.

- Return on Equity – measures the profitability relative to shareholders’ equity, providing insight into how effectively a company uses investments to generate growth.

Overview Of The Us Economic Environment

The economic environment in the USA plays a significant role in determining the viability and profitability of businesses. With its stable GDP growth, low inflation, and large consumer market, the US economy offers a fertile ground for businesses to thrive. It is a hub of innovation, technology, and entrepreneurship, which encourages business growth across various sectors.

The table below presents an outline of the economic context pertinent to business profitability:

| Economic Indicator | Description | Impact on Business Profitability |

|---|---|---|

| GDP Growth Rate | Annual expansion of the economy | Indicates overall economic health, influencing consumer confidence and spending |

| Inflation Rate | Rising prices of goods and services | Affects costs, pricing strategies, and purchasing power |

| Unemployment Rate | Percentage of the labor force that is jobless | Impacts consumer spending and talent availability |

The landscape of the most profitable businesses in the USA is further shaped by regulatory frameworks, technological advancements, and consumer trends. Companies that adapt to these factors often find themselves at the top of the profitability charts. Indeed, a confluence of the right economic conditions with a strong business model and innovative practices can set the stage for unparalleled success.

Trends Shaping The Most Profitable Businesses

Understanding the winds of change that shape the most profitable businesses is crucial to maintaining a competitive edge in the ever-evolving American market. Two major trends stand out in their influence on profitability: technological advancements and shifts in consumer behavior and demographics. These trends don’t just nudge the business landscape; they overhaul it, creating new opportunities and challenges for entrepreneurs and established businesses alike. Let’s explore how these trends are molding the landscape of lucrative ventures.

Impact Of Technological Advancements

The advent of cutting-edge technology has universally impacted the profitability of businesses. In sectors from e-commerce to automation, companies that leverage these advancements gain a significant edge. Here’s how:

- Automation Tools streamline operations, reducing costs and increasing efficiency.

- Advanced Data Analytics provide insights allowing businesses to tailor their strategies precisely to consumer needs.

- E-commerce Platforms facilitate a global marketplace, expanding customer reach beyond traditional geographic limitations.

- Emerging technologies like Blockchain and Internet of Things (IoT) unlock new business models and strategies.

In essence, companies that integrate innovative technologies into their business models are better positioned to generate higher profit margins. This could include automating customer service through AI chatbots, enhancing product personalization using machine learning, or adopting cloud computing to reduce IT expenses.

Shift In Consumer Behavior And Demographics

Demographic shifts and changes in consumer behavior dramatically influence market potential. For instance:

- Millennials and Gen Z, with their distinct values and spending habits, demand authenticity, social responsibility, and digital convenience.

- As the Baby Boomer generation ages, there’s a burgeoning market for health-related products and services.

- Influenced by a growing environmental consciousness, consumers increasingly seek out eco-friendly and sustainable businesses.

Businesses that account for these demographic changes and capitalize on the emerging consumer trends are more likely to find themselves amongst the most profitable. Personalized marketing campaigns, green business practices, and intuitive online shopping experiences are just some of the ways companies are adapting to this shift.

Top Profitable Sectors In The Us Economy

The landscape of American commerce is a dynamic and ever-evolving horizon, rich with opportunity and prosperity. Among the multitude of sectors contributing to the nation’s GDP, certain industries stand out for their remarkable profitability. These sectors not only drive the economy forward but also offer lucrative business ventures for entrepreneurs and investors alike. They act as the robust pillars supporting the vast economic structure of the USA.

Healthcare Industry: A Consistent Performer

Emerging as a colossus in the realm of profit generation, the healthcare industry is integral to the economic vitality of the United States. Assured by an aging population and a growing focus on health and wellness, this sector has proven its resilience and potential for growth, regardless of the global economic climate.

- Rise in chronic diseases – With an increase in lifestyle-related health issues, there is a surging demand for healthcare services.

- Innovative healthcare technology – Cutting-edge medical devices and telehealth services are broadening the scope for profitability.

- Insurance expansion – Policies like the Affordable Care Act have expanded coverage, creating more revenue streams within the industry.

Technology Sector: Innovation As A Profit Driver

constant surge in demand and a culture that celebrates innovation.

| Area | Influence on Profit |

|---|---|

| Artificial Intelligence | AI-driven solutions streamline operations and create new product offerings. |

| Cloud Computing | Remote work trends increase reliance on cloud services, expanding market reach. |

| E-commerce Platforms | Online shopping growth translates to higher revenue for tech platforms. |

Profit margins in the technology sector often exceed those of traditional businesses due to scalability and lower marginal costs. With every innovation, tech companies carve out new niches, paving the path to ceaseless economic gains.

Small Business Ventures With High Profit Margins

When entrepreneurs dream up their ideal business ventures, profit margins often stand at the forefront of their considerations. Small Business Ventures with High Profit Margins are particularly enticing as they typically require less capital investment while promising substantial return on investment. From digital storefronts to specialized consulting services, a myriad of opportunities awaits those looking to corner a profitable niche in the vast American market.

E-commerce: Online Retail Success

The digital revolution has paved the way for E-commerce to become one of the most lucrative business models. With relatively low overhead costs and round-the-clock global access to customers, online retail presents unprecedented opportunities for high profit margins. Key to success in this domain includes:

- Identifying niche products that cater to specific consumer needs

- Maintaining a streamlined inventory to minimize storage costs

- Optimizing the user experience to boost conversion rates

- Implementing strategic digital marketing to reach target demographics effectively

Success stories of small business owners utilizing platforms like Shopify, Etsy, or Amazon Marketplace demonstrate the potential of carefully crafted e-commerce strategies.

Professional Services: Catering To Niche Markets

Professional services offering specialized expertise have burst onto the scene as a highly profitable avenue. These range from legal and financial consultancies to marketing and IT support. Key aspects that ensure such ventures become cash cows include:

- Establishing credibility and expertise in a chosen field

- Customizing services to meet the unique challenges of clients

- Fostering long-term client relationships to ensure recurring business

- Adopting efficient time management and pricing strategies

Professionals who succeed in creating a trusted brand can command premium rates for their services, leading to impressive profit margins and sustainable business growth.

Thriving Large-scale Industries

In the melting pot of opportunities that is the United States of America, certain industries outshine others, contributing to the robust backbone of the nation’s economy. Among these, large-scale industries represent not just the most profitable businesses but also the most influential in terms of innovation, employment, and economic stability. Two sectors notably fuel America’s financial engine:

Energy Sector: Fueling The Economy

The Energy Sector stands as a colossal presence in the US market, essential to both daily life and national security. This sector encompasses a range of activities from oil and gas extraction to power generation and distribution. Its components are:

- Fossil Fuels: Despite an increasing focus on renewables, coal, natural gas, and petroleum remain pivotal.

- Renewable Energy: Solar, wind, and hydroelectric power are growing niches, displaying a surge in presence and profitability.

- Nuclear Power: This area, although controversial, offers large-scale energy solutions with notable profit margins.

The energy sector remains a top contributor to America’s economic prowess, creating jobs and powering industries that drive growth.

Financial Services: Banking On Profits

Financial services sector thrives as the lifeblood of economic activities, enabling transactions, investments, and the management of wealth. Key components of this dynamic sector include:

- Banks: They serve as foundations for deposits, loans, and financial transactions, making profits from interest and fees.

- Insurance Companies: These entities provide a safety net against risks, building their profit model around policy sales and capital management.

- Investment Firms: Specializing in wealth management and asset allocation, they generate earnings through fees and investment gains.

Such financial institutions are instrumental in propelling other industries forward, hence banking substantially on growth and returns.

Profitable Franchise Opportunities

In the quest for business success, aspiring entrepreneurs often look for paths with proven profitability. Franchise opportunities stand out as lucrative ventures, providing a playbook for a flourishing business model while capitalizing on established brand recognition. The American market offers a plethora of franchise options that span various industries, catering to different consumer needs and preferences. Below, we delve into some of the most profitable franchise opportunities, specifically focusing on fast-food chains and fitness franchises.

Fast-food Chains: Savoring The Franchise Model

Fast-food chains are a staple of the American franchise landscape, offering convenience, taste, and familiarity to millions of customers. The robust model of fast-food franchises has proven resilient to economic shifts, often serving as a safe haven for investors. Here are some key reasons for their profitability:

- Streamlined Operations: Systematic processes and training offered by the franchise ensure efficiency and consistency across all locations.

- Brand Loyalty: Trusted names attract a steady stream of clientele willing to spend on well-known flavors and experiences.

- Comprehensive Support: Franchises offer extensive guidance, marketing, and innovation in menu and service, which can translate to higher revenue for franchise holders.

When you opt for a fast-food franchise, you’re investing in a time-tested model that’s synonymous with profitability and widespread appeal.

Fitness Franchises: Capitalizing On Health Trends

With a growing emphasis on health and wellness, fitness franchises are experiencing a surge in popularity. Investing in a fitness franchise means tapping into a market with immense growth potential. Here’s why they are lucrative:

- Diverse Options: From traditional gyms to niche studios focused on yoga, pilates, or high-intensity interval training (HIIT), there’s a fitness franchise for every market segment.

- Recurring Revenue: Membership models provide a steady income stream, with opportunities to boost profits through personal training, classes, and retail.

- Brand Power: Aligning with a recognized fitness brand can drive membership sales and foster a devoted following, bolstering the bottom line.

By choosing a fitness franchise, entrepreneurs align themselves with healthy lifestyle trends that show no signs of waning, creating a fertile ground for financial success.

Real Estate And Property Investments

The landscape of investment opportunities in the USA consistently highlights real estate and property investments as top contenders for profitability. The appeal lies in their potential for significant returns and stability compared to the volatility of other markets. As savvy investors know, real estate not only offers value appreciation over time but can also provide consistent income streams and favorable tax advantages. Let’s delve into the profitability of the two major segments in this sector: commercial and residential properties.

Commercial Real Estate: High-Yield InvestmentsCommercial Real Estate: High-yield Investments

Commercial real estate is a powerhouse when it comes to yielding high returns. Investors can tap into a wide array of properties, from office buildings to retail spaces, each offering its own unique set of financial benefits. What sets commercial real estate apart is the potential for escalating profits and longer lease agreements, which ensure a steady cash flow. An overview of its advantages reveals:

- Stronger cash flow – Typically, commercial properties have higher rent per square foot compared to residential properties.

- Lower vacancy risks – Multi-tenant facilities reduce the risk of income loss from vacancies.

- Long-term tenants – Businesses generally commit to longer leases, securing cash flow stability.

In addition, investors have the opportunity to capitalize on property appreciation and diversify their portfolio across different types of commercial assets.

Residential Rentals: A Steady Income StreamResidential Rentals: A Steady Income Stream

Investing in residential rental properties is akin to planting seeds for a reliable and continuous income stream. Landlords can benefit from the fact that housing is a perpetual necessity, which translates to consistent demand. The keys to success in the residential market include property location, property condition, and proper tenant management. The highlights of residential rental investments cover:

| Factor | Benefit |

|---|---|

| Rental Income | A steady monthly revenue from tenants. |

| Appreciation | Gradual increase in property value over time. |

| Tax Deductions | Expenses like mortgage interest, maintenance, and depreciation can be deducted. |

| Leverage | Ability to finance a portion of the purchase, magnifying ROI. |

Moreover, technological advancements such as property management software make it easier than ever to handle the logistics of managing rental properties, allowing for more efficient operation and cost savings.

The Emergence Of Green And Sustainable Businesses

As the global economy evolves, green and sustainable businesses stand at the forefront of profitability and growth. Companies and consumers alike are prioritizing the planet, turning the spotlight onto enterprises that exemplify environmental responsibility. This shift represents not only a moral imperative but is also paving the path for substantial financial rewards. With an increasing demand for practices that reduce carbon footprints and promote eco-conscious living, various sectors are witnessing a surge in successful, eco-friendly ventures.

Renewable Energy: Powering Future Profits

Amidst the clamor for sustainability, the renewable energy sector stands tall as a beacon of innovation and profitability. Solar, wind, hydro, and bioenergy solutions offer a powerful promise for the future of energy generation, possessing significant investment appeal. Entities engaged in producing and supplying renewable energy are not merely selling power; they are selling hope for a cleaner future which, in turn, is translating into remarkable financial success.

- Lower operational costs through reduced reliance on fossil fuels

- Government incentives that encourage renewable energy adoption

- Increased consumer demand leading to a robust market for green energy

Sustainable Products: Eco-friendly Equals Economically Friendly

Product sustainability is now synonymous with market competitiveness. Eco-friendly products not only address the environmental impact but cater to a growing segment of consumers intent on making responsible purchasing decisions. As a result, companies that integrate sustainability into their product lines are not just championing the environment but are also seeing healthier profit margins.

| Sustainable Product | Market Advantage |

|---|---|

| Biodegradable Packaging | Appeals to waste-conscious consumers and reduces disposal costs |

| Organic Clothing | Carves a niche in the fashion industry, offering a premium brand image |

| Eco-friendly Home Goods | Generates customer loyalty and increases brand value among eco-aware demographics |

By embracing sustainable practices, businesses can tap into a market where green equates to gold. It’s clear that environmentally conscious products are not just a passing trend but a key player in the most profitable businesses in the USA today.

Innovative Tech Start-ups And Silicon Valley

The landscape of American entrepreneurship is brimming with innovation, thanks in large part to the vibrant tech start-ups of Silicon Valley. These cutting-edge companies are the new titans of the business world, continuously pushing the boundaries of what’s possible and redefining industries. From revolutionizing communication to overhauling financial transactions, Silicon Valley start-ups have become synonymous with progressive change and staggering profitability.

Disruption Through Technology: Start-up Success Stories

The power of innovation lies in its capacity to disrupt existing markets and create new ones. Silicon Valley has an illustrious track record of tech start-ups that have done just that. Success stories like Airbnb, Uber, and SpaceX showcase how fresh ideas, when executed effectively, can transform entire sectors and challenge the status quo.

- Airbnb overturned the lodging industry by enabling homeowners to rent out their spaces, thus providing an alternative to traditional hotels.

- Uber redefined urban transportation with its ride-sharing app, making it easier, more efficient, and often cheaper to commute.

- SpaceX, though not a typical start-up, encapsulates the spirit of Silicon Valley by pioneering private space flight and reducing space travel costs.

Venture Capital: Fueling Growth And Profits

Silicon Valley is not just a hub for tech innovation but also the heartland of venture capital (VC). Venture capital firms play a crucial role in the life cycle of a tech start-up by providing the necessary funds to fuel their growth. This infusion of capital often translates into accelerated development, world-class talent acquisition, and expanded market reach—factors essential for profitability.

| VC Firm | Notable Investments |

|---|---|

| Sequoia Capital | Google, Apple, LinkedIn |

| Kleiner Perkins | Amazon, Twitter, Snap Inc. |

| Andreessen Horowitz | Facebook, GitHub, Airbnb |

The influx of VC funding into promising tech start-ups has not only enabled them to disrupt traditional industries but also secured their position as some of the most profitable businesses in the USA.

Impact Of Foreign Investment On Us Businesses

The vibrant tapestry of the US economy is continually influenced by an array of international threads, where foreign investment plays a significant role in shaping the business landscape. Not only does it serve as a catalyst for domestic companies seeking expansion, but it often becomes a pivotal factor in steering them toward profitability pinnacle. The influx of foreign investment serves as both a testament to the robustness of the US businesses and an opportunity for economic diversification.

Global Partnerships And Their Profit Impact

In the interconnected world economy, global partnerships have risen as vital contributors to the success of many US businesses. Strategic alliances with foreign investors can provide American companies with numerous advantages including:

- Access to new markets through the foreign partners’ local knowledge and networks.

- Enhanced financial resources allowing for accelerated growth and scalability.

- Innovation cross-pollination where shared knowledge leads to technological advancements and product diversification.

These partnerships deeply influence profitability. They not only open up horizons for increased revenue streams but also enable cost reduction through shared resources. As a result, US companies can achieve better market positions and higher profits.

Attracting Foreign Capital For Domestic Growth

Attracting foreign capital is crucial for the economic vitality of any country, and the USA is no exception. With a focus on promoting an investment-friendly climate, US businesses can tap into this valuable resource to fuel their growth, innovation, and expansion strategies.

Several mechanisms are in place to draw foreign capital, which includes:

- Competitive tax incentives and business-friendly regulations.

- Robust infrastructure enabling efficient operations and logistics.

- Skilled workforce offering high productivity rates.

By securing foreign investments, US businesses are far better equipped to make significant strides in their respective industries. This foreign capital directly translates into new jobs, advanced technologies, and an invigorated business sector – all of which culminate in bolstered profitability and sustained economic growth.

Analyzing The Role Of Government Policies

Understanding the current profitability of businesses in the USA requires a careful look at the governmental arena where policies and incentives significantly sway the scales of success. As we delve into the intricate framework stitched by complex legislation, it becomes evident how pivotal these policies are for molding the profitability and survival of businesses. Analyzing the role of government policies offers a window into a world where the interplay between regulations and commercial profitability unfolds.

Tax Incentives And Their Influence On Profitability

Tax incentives stand out as a pivotal factor in the pursuit of business profitability, acting as levers that the government can pull to either fuel or dampen business growth. By strategically targeting key sectors, these incentives can lead to a surge in investment and enterprise development, paving the path for businesses to capitalize on reduced operational costs and improved bottom lines.

- R&D Tax Credits: Companies investing in new technologies or product development can offset their costs substantially, promoting innovative ventures and potentially high-yield outcomes.

- Small Business Deductions: Tailored to give smaller entities a fighting chance, these deductions help businesses keep more capital circulating within, fostering growth and scalability.

- Opportunity Zones: Investments in designated regions come with beneficial tax treatment, sparking business ventures in areas that might otherwise remain overlooked.

Such incentives have a domino effect on the economy, where increased profitability from tax breaks leads to more jobs, higher wages, and a robust business cycle.

Regulations That Shape The Business Landscape

In the same vein, regulations also act as architects shaping the business milieu. While some regulations ensure fair play and consumer protection, others might inadvertently stifle innovation or create barriers to entry for new players.

For instance:

| Regulation | Impact |

|---|---|

| Financial Regulations | Protect investors but increase compliance costs for businesses. |

| Environmental Standards | Encourage sustainable practices, yet might necessitate significant business investment. |

| Healthcare Mandates | Ensure employee welfare, however, inflate the operational expenses of companies. |

The challenge for businesses lies in navigating this regulatory landscape effectively to maintain compliance without eroding their profit margins. Thus, the role of government policies is not static but a dynamic force influencing the profitability and operational strategies of businesses across the spectrum in the USA.

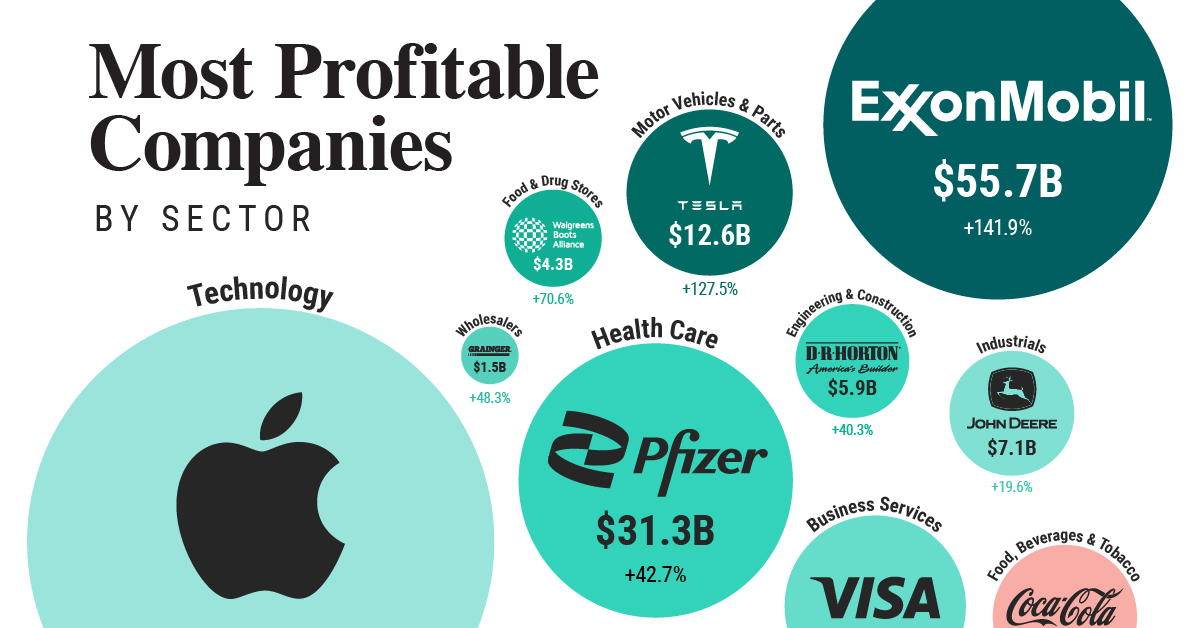

Credit: www.visualcapitalist.com

The Future Of Profitability In Us Businesses

Exploring the future of profitability in US businesses unveils an optimistic landscape where innovation and adaptability reign supreme. Beyond traditional powerhouses, emergent sectors hint at a wealth of opportunity, shaping the next frontier for entrepreneurs and investors alike. How, then, will the shifting tides of the economy influence the profitability of tomorrow’s enterprises, and what does this mean for those poised to capitalize on these trends?

Potential For Growth In Emerging Industries

The United States stands at the cusp of a transformative era in commerce, propelled by emerging industries brimming with potential for exponential growth. Consider the strides in technology sectors such as artificial intelligence, renewable energy, and biotechnology. These arenas not only forecast substantial financial gain but also promise to redefine the methodologies by which industries operate.

- Artificial Intelligence (AI): A driver of efficiency and innovation, AI is primed to infuse businesses with predictive analytics and automation, unlocking new revenue streams.

- Renewable Energy: The sustainable revolution is surging, and with it, the demand for green tech solutions—spelling profits for businesses that can lead the eco-friendly charge.

- Biotechnology: Tailored medical solutions are the future, paving the way for personalized treatment options and a vibrant market for pioneers in healthcare advancements.

Challenges And Opportunities In The Evolving Market

With growth comes challenge, and the evolving US market is no exception. Entrepreneurs must navigate a maze of regulatory demands, technological disruptions, and economic shifts. Yet, within these challenges lie untapped opportunities for businesses that can turn obstacles into stepping stones.

| Challenge | Opportunity |

|---|---|

| Data Security | Development of advanced cybersecurity services |

| Economic Uncertainty | Diversification and agile business models |

| Labor Market Fluctuations | Investment in automation and remote work infrastructure |

It’s clear that firms that embrace adaptability, invest in continual learning, and build a culture of innovative thinking will find themselves at the forefront of the profitability curve in the US business landscape.

Credit: fortune.com

Conclusion

Exploring the most profitable businesses in the USA offers valuable insights into economic trends. Entrepreneurs can harness these ideas to launch or pivot into lucrative markets. Remember, success hinges on innovation, customer understanding, and strategic planning. Ready to join the ranks of top earners?

Your next opportunity awaits!